|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

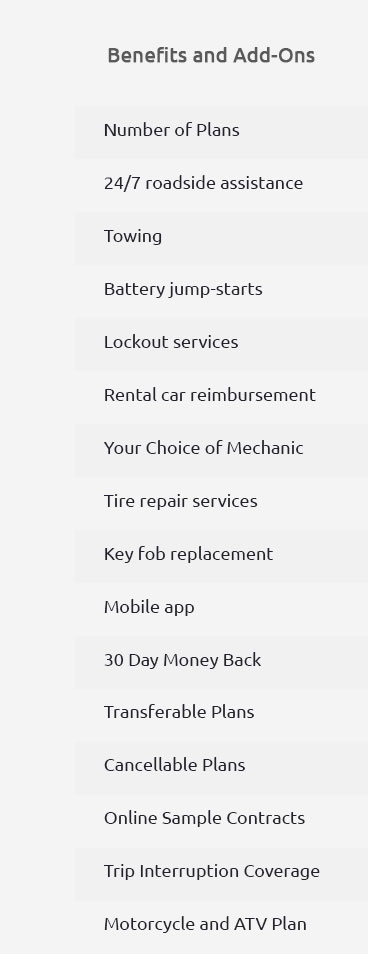

Vehicle Insurance Plan: Coverage GuideUnderstanding the ins and outs of a vehicle insurance plan can provide U.S. consumers with peace of mind and significant cost savings. Whether you are protecting your car against unforeseen repair costs or exploring extended auto warranties, this guide will help you navigate your options. Understanding Vehicle Insurance CoverageA vehicle insurance plan typically covers a range of areas to protect your financial interests in case of accidents or damage. Basic Coverage Types

For those in California, understanding local laws and coverage requirements is crucial. The same applies to residents in Texas who may face different regulatory standards. Benefits of Extended Auto WarrantiesExtended auto warranties can be a game-changer, especially for high-mileage vehicles. They offer protection beyond the manufacturer's warranty, saving you from potential hefty repair bills.

If you’re looking for the best auto warranty usa, explore plans that offer customizable options. Cost BreakdownThe cost of a vehicle insurance plan can vary widely based on factors such as age, driving history, and location. Factors Influencing Cost

Drivers in New York might face higher premiums due to dense traffic, while rural areas may offer lower rates. FAQsWhat does a vehicle insurance plan typically cover?A vehicle insurance plan generally covers liability, collision, and comprehensive risks. It protects against property damage, theft, and accident-related medical expenses. Is an extended auto warranty worth it for high-mileage cars?Yes, an extended auto warranty can be especially beneficial for high-mileage vehicles, providing coverage for wear and tear that occurs over time. For more information, visit best high mileage auto warranty. How can I lower my insurance premium?Maintaining a clean driving record, opting for higher deductibles, and installing safety features in your car can help lower your premium. https://www.nj.gov/dobi/division_consumers/insurance/dollaradayqna.htm

The Special Automobile Insurance Policy (SAIP) is an initiative to help make limited auto insurance coverage available to drivers who are eligible for Federal ... https://www.nj.gov/dobi/division_consumers/insurance/basicpolicy.shtml

Auto insurance is mandatory in New Jersey, but the type and cost of that coverage can vary significantly. Every day, consumers are finding that there are ... https://www.thehartford.com/aarp/car-insurance

The AARP Auto Insurance Program from The Hartford offers a savings of up to 10% for simply having an AARP membership.

|